Domain-Driven Design

Domain-Driven Design (DDD) is an approach for building high-quality products that meet the needs of a business and its customers. It emphasizes collaboration among domain experts, product managers, designers, engineers, and other disciplines to create a domain model that reflects these needs. This involves agreeing on common terminology, identifying business entities, and documenting the relationships between those entities and their behavior.

Why is this important? I have seen many projects delayed or even fail because the team did not understand the domain or the needs of the business clearly. There may be confusion because team members use similar terms that have overlapping meaning. This results in incorrect interpretation of requirements, a mismatch between front-end and back-end concepts, confusing APIs, confusing terms that your customers don't understand, and a whole slew of other problems.

On a recent project, my team debated the differences between alerts, notifications, and events because these terms were being used interchangeably. No one had clear definitions in their heads. This costed us several weeks of productivity. Does this scenario sound familiar? Domain-Driven Design is the tried-and-tested way to solve this problem. Many successful organizations depend on it to clearly articulate domain concepts and deliver mission-critical systems.

This article explains how to use DDD, the concepts you'll need to know, and how to work with your team to build high-quality products. It is geared toward technical and non-technical readers. The first three sections (including this section, 2 – Ubiquitous Language, and 3 – Domain Model) gently introduce everyone to these concepts. If you are an engineer, go through the remaining sections to understand how to translate the domain model into a working implementation.

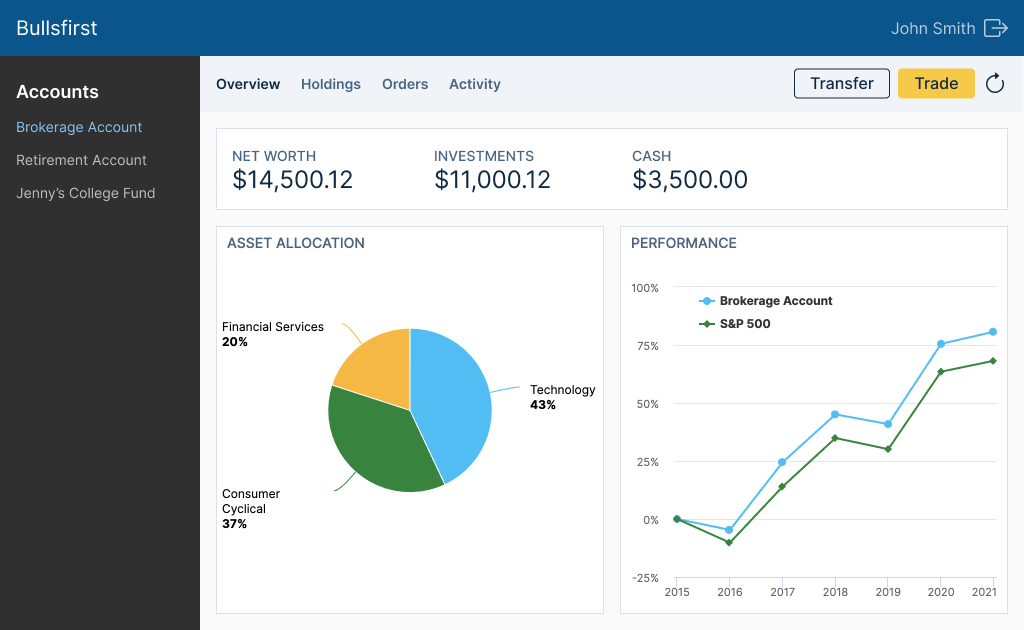

We'll use the example of a sample trading application, called Bullsfirst along the way. Here's what the application looks like:

Bullsfirst allows traders to open an account at a brokerage firm. They can then place orders to buy and sell securities. The brokerage firm places the orders in an exchange where they can be executed.